Here are the latest luxury market statistics and trends to learn more about the luxury goods shopping and spending behavior of consumers.

The luxury goods market is a constantly evolving and dynamic sector that encompasses a wide range of industries such as fashion, beauty, automobiles, travel, and hospitality, among others.

The global luxury market has witnessed substantial growth in recent years, fueled by the rise of the middle class in emerging markets, increasing consumer awareness, and the growing popularity of luxury brands among younger generations.

The growth of the luxury market is being driven by a variety of factors, including the increasing demand for high-end products and experiences, the rise of e-commerce and online sales channels, and the increasing focus on sustainability and social responsibility.

In this context, it is important to understand the latest trends and statistics in the luxury market to make informed decisions and stay ahead of the competition.

Most Interesting Luxury Market Statistics

- The Luxury Goods market is projected to generate US$354.80 billion in revenue in 2023, with an annual growth rate of 3.38% (CAGR 2023-2028).

- The global market for luxury goods is projected to reach USD 369.8 billion by 2030.

- Online sales will account for 22.4% of total revenue in the Luxury Goods market by 2023.

- The luxury market’s consumer base is expected to expand from 400 million people in 2022 to 500 million by 2030.

- The largest segment in the market is Luxury Fashion, which is expected to reach US$111.50 billion in 2023.

- Gen Y and Gen Z are identified as power drivers by leading the growth of the luxury goods market.

- Gen Y and Gen Z will make up a third of the luxury goods market by 2030.

- The spending by Gen Z and Gen Alpha is set to grow three times faster than for other generations until 2030.

- Gen Z purchases luxury items around the age of 15, which is three to five years earlier than millennials.

- The United States is the top revenue-generating country in the global comparison, with an expected revenue of US$75,690.00 million in 2023.

- China is expected to reach a market size of US$42.4 Billion by 2030, with a CAGR of 7.3% from 2022 to 2030.

- India’s luxury market could grow to 3.5 times its current size by 2030.

Luxury Market Statistics

1. The Luxury Goods market is projected to generate US$354.80 billion in revenue in 2023, with an annual growth rate of 3.38% (CAGR 2023-2028). (Statista)

2. The global market for luxury goods is projected to reach USD 369.8 billion by 2030. (Luxury Goods: Global Strategic Business Report)

3. Online sales will account for 22.4% of total revenue in the Luxury Goods market by 2023. (Statista)

4. The luxury market’s consumer base is expected to expand from 400 million people in 2022 to 500 million by 2030. (Bain & Company)

5. In 2022, 95% of luxury brands experienced positive growth. (Bain & Company)

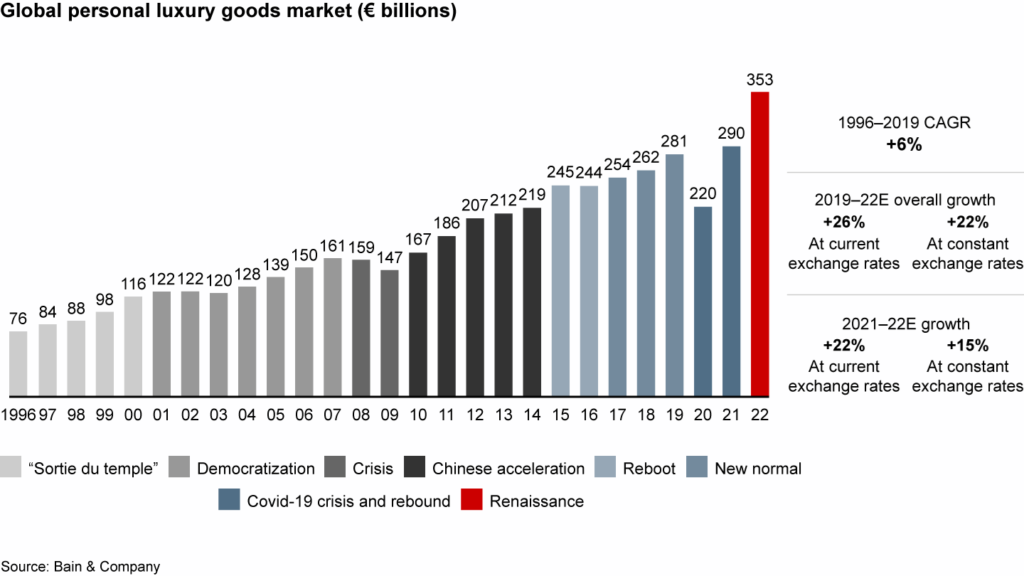

6. The personal luxury goods market is expected to show accelerated growth of 22% to €353 billion. (Bain & Company)

7. Despite a potential downturn in global economic conditions, the personal luxury market is projected to see further growth of at least 3-8% in the coming year and is expected to reach a market value of around €540-580 billion by 2030, a rise of 60% or more compared to 2022. (Bain & Company)

8. Revenues of US$46.18 are expected to be generated on a per-person basis in 2023. (Statista)

9. The largest segment in the market is Luxury Fashion, which is expected to reach US$111.50 billion in 2023. (Statista)

10. The Apparel segment is expected to reach US$115.4 Billion by 2030, recording a CAGR of 6.7%. (Luxury Goods: Global Strategic Business Report)

11. Accessories remained the largest personal luxury goods category, growing by 21%-23%. (Bain & Company)

12. The luxury goods market continues to be purchased at a consistent rate despite an incoming recession. (Bain & Company)

Luxury Market & Shopping Statistics of Millennials, Gen Y, Gen Z & Gen Alpha

1. Gen Y and Gen Z are identified as power drivers by leading the growth of the luxury goods market. (Bain & Company)

2. In 2022, millennials and Gen Z accounted for 72% of the global luxury market. (Bain & Company)

3. Gen Y and Gen Z accounting for all of the Luxury Market’s growth in 2022. (Bain & Company)

4. Gen Y and Gen Z will make up a third of the luxury goods market by 2030. (Bain & Company)

5. The spending by Gen Z and Gen Alpha is set to grow three times faster than for other generations until 2030. (Bain & Company)

6. Gen Z purchases luxury items around the age of 15, which is three to five years earlier than millennials. (Bain & Company)

Luxury Goods Market in the United States

1. The United States is the top revenue-generating country in the global comparison, with an expected revenue of US$75,690.00 million in 2023. (Statista)

2. The Luxury Goods market in the United States is expected to generate US$75.69 billion in revenue in 2023, with an annual growth rate of 1.94% (CAGR 2023-2028). (Statista)

3. The Luxury Goods market is projected to generate revenues of US$224.80 per US resident based on total population figures by 2023. (Statista)

4. Online sales are estimated to contribute 20.5% of the total revenue in the Luxury Goods market in the United States by 2023. (Statista)

Growing Luxury Goods Market Countries Statistics

1. The US and Europe are still the leading luxury markets, but new markets are emerging. (Bain & Company)

2. China is expected to reach a market size of US$42.4 Billion by 2030, with a CAGR of 7.3% from 2022 to 2030. (Luxury Goods: Global Strategic Business Report)

3. Japan and Canada are forecast to grow at 4.2% and 5.6%, respectively, over the 2022-2030 period. (Luxury Goods: Global Strategic Business Report)

4. Germany is predicted to grow at approximately 4% CAGR in Europe. (Luxury Goods: Global Strategic Business Report)

5. The Asia-Pacific market, led by countries like Australia, India, and South Korea, is forecast to reach US$60.9 Billion by 2030. (Luxury Goods: Global Strategic Business Report)

6. India’s luxury market could grow to 3.5 times its current size by 2030. (Bain & Company)

Types of Luxury Goods Brands

Luxury goods brands can be categorized into several types based on their positioning, price point, and target audience. Here are some of the most common types:

- Heritage Brands: These brands have a long history and tradition, often dating back to the 19th or early 20th century. They are known for their classic and timeless designs, and they often command high prices.

- Fashion Houses: These brands are primarily known for their fashion and apparel lines, but they also offer other luxury goods such as handbags, shoes, and accessories. They are typically trend-focused and cater to a younger, fashion-conscious audience.

- Lifestyle Brands: These brands offer a range of luxury goods that reflect a particular lifestyle or aesthetic. Examples include Ralph Lauren (preppy), Hermes (equestrian), and Chanel (Parisian chic).

- Artisanal Brands: These brands specialize in handcrafted goods made by skilled artisans using traditional techniques. Examples include Bottega Veneta (leather goods), Faberge (jewelry), and Baccarat (crystal).

- Contemporary Luxury Brands: These brands offer luxury goods that are more accessible in terms of price point and style, targeting a younger and more diverse audience. Examples include Gucci, Balenciaga, and Saint Laurent.

- Ultra-Luxury Brands: These brands offer the most exclusive and expensive luxury goods, often customized to the individual customer. Examples include Rolls-Royce (automobiles), Patek Philippe (watches), and Louis XIII (cognac).

Conclusion for Luxury Market Statistics

The luxury market continues to show growth and resilience despite global economic conditions. The market is driven by generational trends, with Millennials and Gen Z being the main consumers.

The Asia-Pacific region, led by countries such as Australia, India, and South Korea, is expected to see the highest growth, while established markets such as the US and Europe remain strong. Online sales are also becoming increasingly important in the luxury market.

Overall, the luxury market presents opportunities for growth and innovation for brands that are able to adapt to changing consumer preferences and behaviors.

Sources:

- Statista

- Bain & Company [1], [2]

- Luxury Goods: Global Strategic Business Report

More Statistics: